New Tax Residency Tests - Proposed "Bright Line" and Factor Tests

In the 2021 Federal Budget the Australian Treasurer indicated that the current Australian tax residency rules would be replaced with a "new, modernised framework".

"The primary test will be a simple ‘bright line’ test - a person who is physically present in Australia for 183 days or more in any income year will be an Australian tax resident. Individuals who do not meet the primary test will be subject to secondary tests that depend on a combination of "physical presence and measurable, objective criteria".

Current Status: Reaction to Tax Residency Consultation Paper

![]() Australian expats should be aware of proposed changes to how tax residency may occur in the future. These changes could profoundly impact the tax residency status of Australians who return home for relatively short periods of time (45 days or more in a tax year).

Australian expats should be aware of proposed changes to how tax residency may occur in the future. These changes could profoundly impact the tax residency status of Australians who return home for relatively short periods of time (45 days or more in a tax year).

The Australian Treasury released a Consultation paper on the proposed New Tax Residency rules which required feedback required by September, 2023. Despite the substantial interim period we have yet to hear the Government's formal response to feedback and there has been no mention of any changes in subsequent Federal Budgets.

In practice, July 2026 is now the earliest prospective date that these new rules could be introduced but we are beginning to wonder whether the proposal has in effect been shelved, given very much larger priorities.

In general, we continue to believe that while there were obvious issues attaching to the determination of tax residency in Australia, they did not require wholesale change, and our concern is that the proposed changes were driven more by desire to cast the revenue net wider than they were about simplicity, clarity and reform.

Although the original Board of Taxation (BoT) working group indicated that they had canvassed widely with a variety of stakeholders, the working group was dominated by tax professionals from the large accounting firms and representatives of Treasury and the ATO. This group is inherently likely to be more sensitive to the views of the ATO and large business groups than to individual expatriates.

It is also hard to accept protestations that the rules will be "revenue neutral", particularly given clear statements that the intention was to make "tax residency more adhesive".

However, a short number of specific comments:

- The Consultation paper, consistent with the original BoT proposal, includes an "overseas employment rule", indicating that an employment offer for a period "of more than two years" would be adequate to break tax residency once other requirements are satisfied. In practice, a rule based on an employment contract of "two or more years" would be (much) preferable. Importantly, however, we also presume - although there is no direct statement to this effect - that it would clarify that the residency of the individual's spouse and family would have no impact on their individual tax residency status.

The new rules however threaten to introduce a new element of discrimination by making it easier for individuals in traditional "employee" roles to break residency compared to those proceeding overseas on a self employed basis, or without a prior job offer. - The continued maintenance of the maximum 45 day period and expats can be resident in Australia before being considered tax resident is a disappointing response. It will be difficult to manage in cases where expats have regional responsibilities, school-aged children or elderly parents based in Australia, and in practice will mean that family holidays and visits will perhaps need to take place overseas rather than in Australia.

- There is still no mention is made of transitional provisions. As we have stated elsewhere, individual expatriates should be able to rely upon professional advice provided in relation to residency under the current rules and be effectively grandfathered. It would be naïve in the extreme to assume that the new rules will not require judicial interpretation - we are jettisoning years of legal precedent - no matter how well drafted. Consequently, we would expect a heightened level of uncertainty around tax residency for years to come.

A Summary of the Proposed New Tax Residency Rules

The proposed framework is based on recommendations made by the Board of Taxation in 2019 and it should be noted that in the Consultation document which preceded those recommendations referenced a number of guiding principles followed by the Board, including:

"Adhesive residency: it should be harder to cease residency than it is to establish it. Generally, once sufficient time is spent in Australia, and their connections are sufficiently embedded, then it is appropriate that this level of engagement with and benefit from Australian society must be scaled back to a large extent before residency ceases."

Consequently, apart from pursuing greater clarity, the Board specifically aimed to make it more difficult for individuals to break tax residency. From a Government perspective there is very little downside associated with this approach - with the tax net being cast wider, bringing in potentially greater revenue from individuals who often have no voting rights under current electoral rules.

Below we provide a summary of recommendations, as we understand them, but stress that it is not possible to provide professional advice regarding how the new rules "might apply in practice - there just continues to be too much uncertainty to make what are often fine judgements in relation to residency in the absence of legislation and some indication of what transitional arrangements (might perhaps) apply.

Incoming and Outgoing Residents

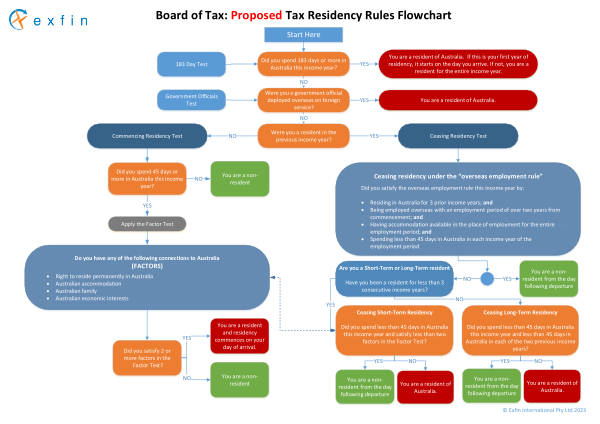

As mentioned above, the key feature of the Board of Taxation report is a focus on what is referred to as bright line ‘days count’ tests to provide clarity and simplicity. We discuss these below and have also prepared a flowchart which is available at the bottom of this page.

Incoming Tax Residents

For individuals who are currently non-resident for Australian tax purposes:

1. 183 day test

An individual who spends 183 days or more in Australia in an income year would be a tax resident for that income year, regardless of the person’s broader circumstances. If you haven't spent 183 days or more, move to the next test

2. 45 day test

Did you spend between 45-182 days in Australia during the financial year?

If you did not, then you are not resident for tax purposes, but if you did then proceed to the factor tests below. It is this brightline test that causes most consternation to expats and the prospect of being considered a tax resident by spending more than 45 days in Australia during a tax year - given that many will meet the "two or more" of the factor tests below.

3. Factor Tests

The Board indicated that the nature and composition of these factors should be determined in consultation, but the broad intention is that if you meet two of more of these factors, you are deemed as an Australian tax resident from the first day you arrive in Australia:

- Right to reside permanently in Australia: Are you an Australian Citizen or a permanent resident?

- Australian Accommodation: Do you have an arrangement at any time to stay in a property kept for your sole use?

- Australian Family: Do you have a spouse and/or children under the age of 18 in Australia?

- Australian Economic Interests: Do you have substantial Australian economic ties (such as employment or business interests)

Regardless of the precise approach adopted it should be appreciated that, consistent with current law, an individual's tax residency might be determined, not by the Australian domestic income tax laws, but also by the tie-breaker tests in a Double Tax Agreement (DTA). DTA's generally override the domestic law to the extent of any inconsistency. Hence a taxpayer in the UK, US and Singapore - countries with which Australia has a DTA - may benefit from tiebreaker tests, while for expatriates in countries such as Hong Kong or the Middle East, the day tests may be critically important.

Just note however that relying upon tie-breaker provisions won't necessarily provide you with absolute clarity - and can give rise to more compliance costs.

Outgoing Tax Residents

Under the proposed new rules, a taxpayer only stops being an Australian tax resident if they meet one of three tests.

1. Do you meet the "overseas employment rule" - an individual taxpayer will cease Australian tax residency from the day of departure if they meet all the following factors:

- they have been residing in Australia for the three prior income years

- they are employed overseas with an employment period of over two years from commencement

- they have accommodation available in the place of employment for the entire employment period

- they will spend less than 45 days in Australia in each income year of the employment period.

2. Do you meet the ‘short-term residents’ rule - a ‘short-term resident’ is someone who has been a tax resident of Australia for less than three consecutive income years. To stop being a tax resident, a taxpayer would need to:

- spend less than 45 days in Australia in the income year; and

- satisfy fewer than two factors (i.e. one or none) of the ‘Factor Tests’ above.

The third proposed test applies to ‘long-term residents’. A ‘long-term resident’ is not a ‘short-term resident’. To stop being a tax resident, a long-term resident would need to spend less than 45 days in Australia in:

- the income year; and

- each of the two previous income years.

The effect of the last test is that residency is "adhesive", clinging to the individual who has been a long-term tax resident of Australia – consistent with the Board's objectives above but not necessarily on an equitable or fair basis.

Grandfathering

The Board's 2019 report suggested that a move to new residency rule would be subject to, "grandfathering or other transitional arrangements that will require further consideration". These are going to be potentially very important for existing expats but following those initial comments no statements have been made regarding how the transition will be managed - there is a very concerning policy vacuum at the moment.

Flowchart - Proposed New Tax Residency Rules

Maintaining a Travel Log

![]() As a matter of practice, given that incoming and outgoing stamps are no longer placed in passports, and bearing in mind the prospect of new tax residency rules, all expats should maintain a log containing dates of entry and exit from Australia and flight numbers. This can be important information in terms of determining residency and the ATO has access to precise data from immigration records.

As a matter of practice, given that incoming and outgoing stamps are no longer placed in passports, and bearing in mind the prospect of new tax residency rules, all expats should maintain a log containing dates of entry and exit from Australia and flight numbers. This can be important information in terms of determining residency and the ATO has access to precise data from immigration records.

If you would like to arrange professional advice please complete the Inquiry form below providing details and you will be contacted promptly.